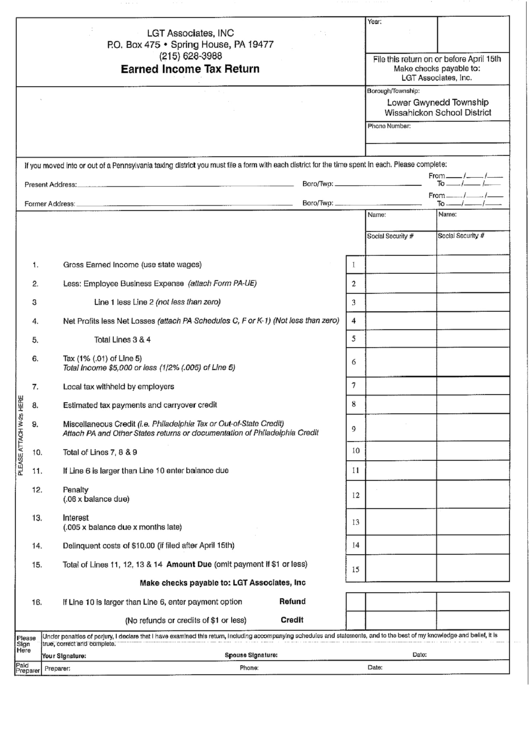

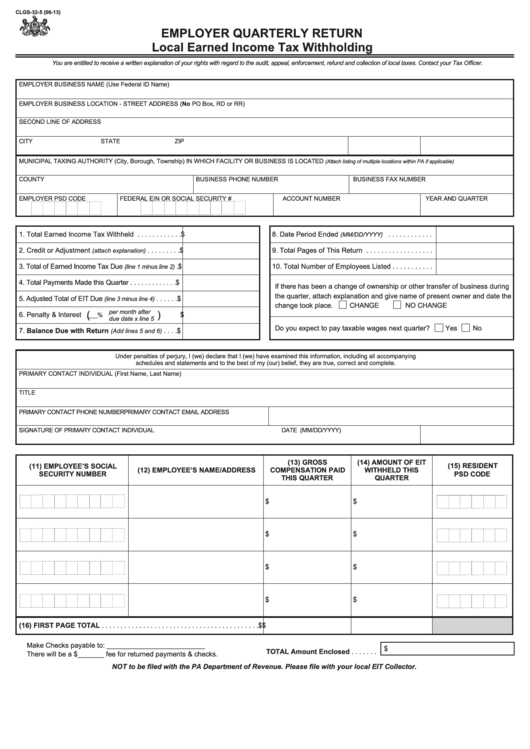

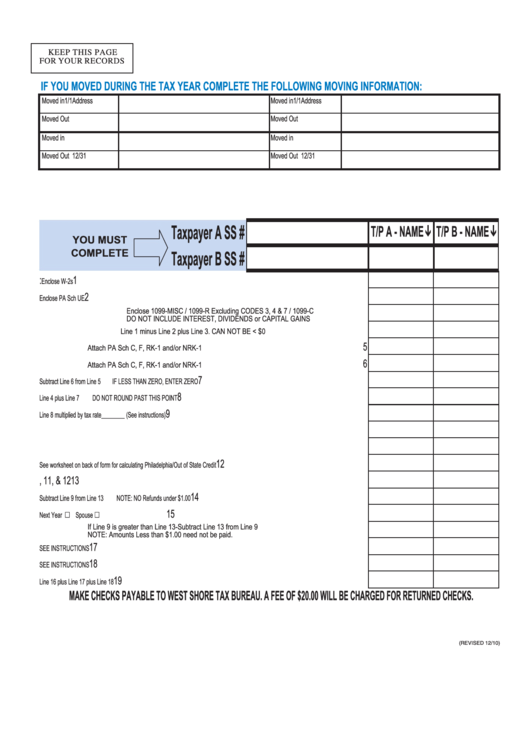

To connect with the Governor’s Center for Local Government Services (GCLGS) by phone, call 888.223.6837. Please contact the Philadelphia Dept of Revenue ( ) or your local Tax Collector for additional information.ĭownload the list of Local Income Tax Collector into excel. The rate is one (1.0) percent of earned income. As an employer, you must pay careful attention to the local taxes where your employees work. Horsham Township levies an Earned Income tax on its citizens and all non-residents who work in the Township. Only localities in states with state income tax impose a local income tax.

Philadelphia City imposes and collects a wage tax for individuals that work and reside within the city, but is not subject to the provisions of Act 32. The local income tax is in addition to federal income and state income taxes.

0 kommentar(er)

0 kommentar(er)